Program Overview

Growing a stronger Kansas economy, together.

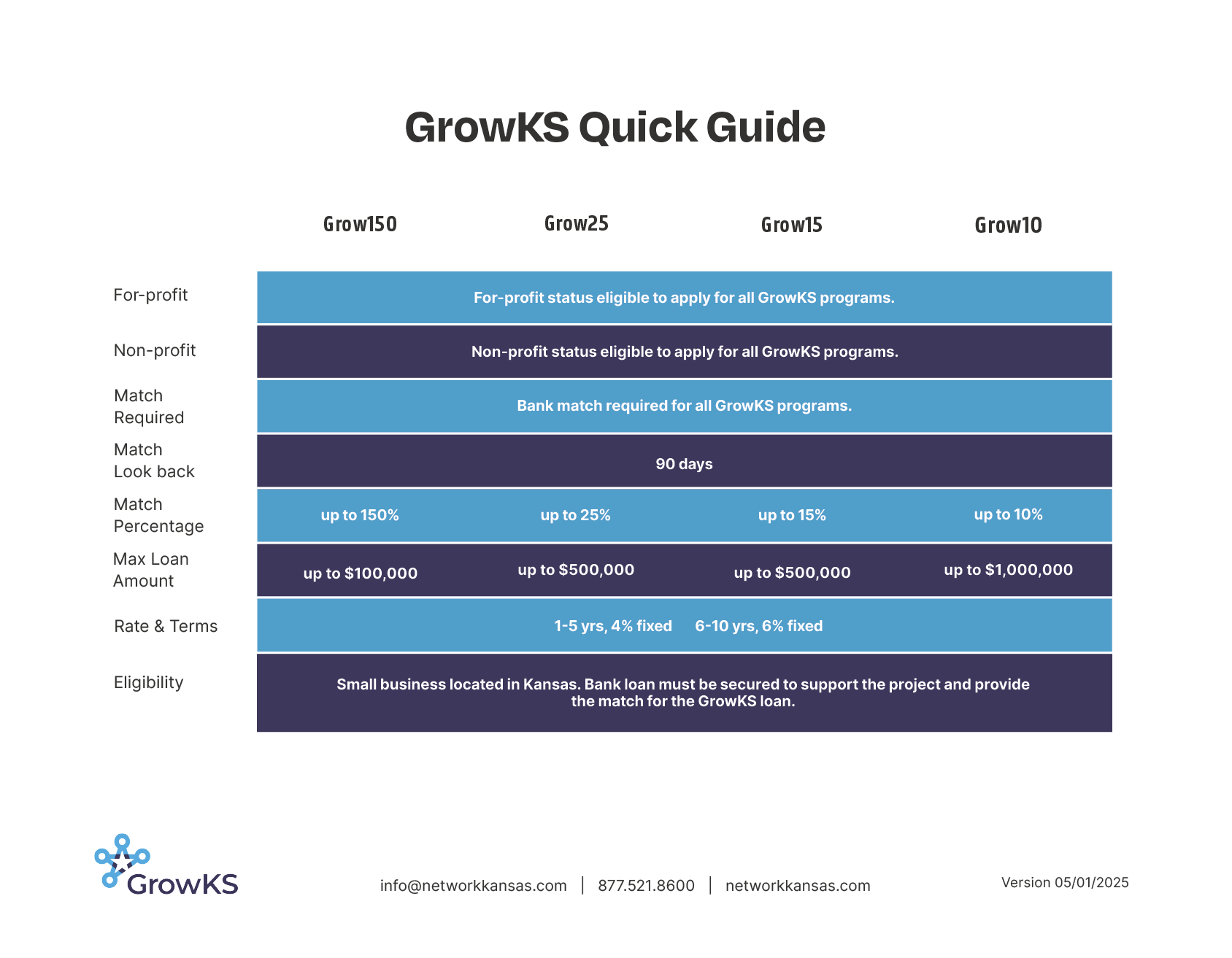

GrowKS Loan and Equity Programs provide equity and loans funded by the U.S. Department of the Treasury’s State Small Business Credit Initiative. The programs are overseen by the Kansas Department of Commerce and Network Kansas and offers a variety of match amounts of up to $1 Million.

As the state’s lead economic development agency, the Kansas Department of Commerce strives to empower individuals, businesses and communities to achieve prosperity in Kansas. Kansas Commerce accomplishes its mission by developing relationships with corporations, site location consultants and stakeholders in Kansas and nationwide. Our strong partnerships allow us to help create an environment for existing Kansas businesses to grow and foster an innovative competitive landscape for new businesses.

Kansas has received $69 million+ to support small business funding

Strengthening the economic landscape for Kansas entrepreneurs gained significant momentum following the U.S. Department of the Treasury’s announcement of $69 million being awarded to the Sunflower State.

Kansas was among the first five states to receive funding.

The allocation more than quadrupled the amount of funding Kansas received during State Small Business Credit Initiative (SSBCI) 1.0.

Additional Details

- All entrepreneurs/small businesses interested in applying will need to be connected with a Network Kansas-approved resource partner. This list of approved partners may include Kansas non-profit organizations such as Certified Development Companies and other technical assistance providers. It also may include some eCommunities. Please email info@networkkansas.com or call 1-877-521-8600 to be connected with the appropriate partner to start the process.

- Kansas was allocated about $69M in State Small Business Credit Initiative (SSBCI) dollars.

- The programs created as a result of the allocation are called the GrowKS Loan Fund and GrowKS Equity Programs.

- GrowKS Loan Fund and GrowKS Equity programs will provide loans and equity investments that match private capital investment.

- The programs are designed to focus on underserved geographies (rural/urban-distressed/statewide), underserved populations (minority/women/economically disadvantaged) and business types (target sector).

- Any private funds we match must include funding from a financial institution (bank, CDFI, etc.)