"[Network Kansas] was there to point me in the right direction and was ready to work with me at every step. "

— Israel Luna, GrowKS Recipient, Hays, KS

Loan Programs

Empowering Entrepreneurs with Funding Solutions

Program Overview

Our Loan Programs provide additional financial resources for entrepreneurs and small businesses who face challenges in securing traditional funding. Whether you’re looking to start a new venture, expand an existing business, or overcome financial hurdles, we’re here to help. Through our partnership-driven model, we connect businesses with lenders and ensure that projects get the necessary support to move forward.

What Makes Us Different?

- Target Audience: Small businesses in Kansas, with a focus on underserved populations such as rural, urban-distressed, minority-owned, and women-owned businesses.

- Loan Matching: Network Kansas offers matching loans to assist other funders in closing deals. Our terms are designed to help entrepreneurs get the resources they need with favorable rates and conditions.

- Support: Participants gain access to the Network Kansas system, with opportunities to be supported by our Impact Investment Center, our Programming Department and Technical Assistance funding.

- Bridging the Funding Gap: Access to additional capital when traditional funding is not enough.

- Support for Lenders: Lenders can reduce risk and help fund projects that might otherwise be unviable.

- Tailored Terms: Flexible loan terms and interest rates, with options to match other funding sources.

Step-by-Step Loan Application Journey

What does it look like to get a loan?

1. Connect with a Funding Partner

If you’re already working with a funding partner (such as a bank, economic development organization, or other financial institutions), they will help you begin the application process. Your partner will collect the necessary documents and submit your loan application on your behalf.

2. Submit Your Application

Once your funding partner has all the required information, they will submit your completed application to Network Kansas for review.

3. Application Review

Network Kansas reviews loan applications twice a month. Your application will be reviewed internally, typically within two weeks.

4. Loan Status Communication

After the review process, Network Kansas will communicate directly with your funding partner to inform them of the loan approval status.

5. Closing Documents Preparation

If your loan is approved, Network Kansas will electronically send closing documents to either the borrower or the funding partner. The funding partner will collaborate with Network Kansas to gather and finalize all materials needed to complete the deal.

6. Receive Loan Funds

Once the closing documents are finalized, you can expect to receive your loan funds within 10 business days.

7. Annual Follow-Up

The Impact Investment Center will check in with you annually to track your business’s progress and impact. This follow-up continues until your loan is paid in full.

Frequently Asked Questions (FAQ)

Who is eligible for Network Kansas Loan Programs?

Kansas-based small businesses, including for-profit and non-profit organizations, with a focus on those that are minority-owned, women-owned, or located in rural or urban-distressed areas.

How do I apply for a loan?

You must apply through an approved funding partner. If you’re already working with a partner, they will handle the application process for you. You will need to submit documents to your partner, who will submit the full application to Network Kansas. If you are not yet connected with a funding partner, contact our Impact Investing Center.

What is the application process?

Applications are reviewed bi-weekly. Once approved, closing documents are sent, and businesses typically receive funds within 10 business days. For our eCommunity Loan Program, the review timeline is determined by the local Financial Review Board.

How much can I borrow?

Loan amounts vary by program but can be up to $1 million, with terms from 1 to 10 years,depending on the specific loan program.

Do I need to provide collateral?

Collateral requirements vary depending on the program and the lender. The Network Kansas Loan Programs are designed to reduce risk for lenders, making them more likely to approve deals that might otherwise not qualify.

What happens after I receive the loan?

Loan payments are set up via ACH and automatically paid monthly per the scheduled agreement. Network Kansas will follow up annually to track the loan’s impact and ensure that the business remains on track.

Are there matching requirements for the loan?

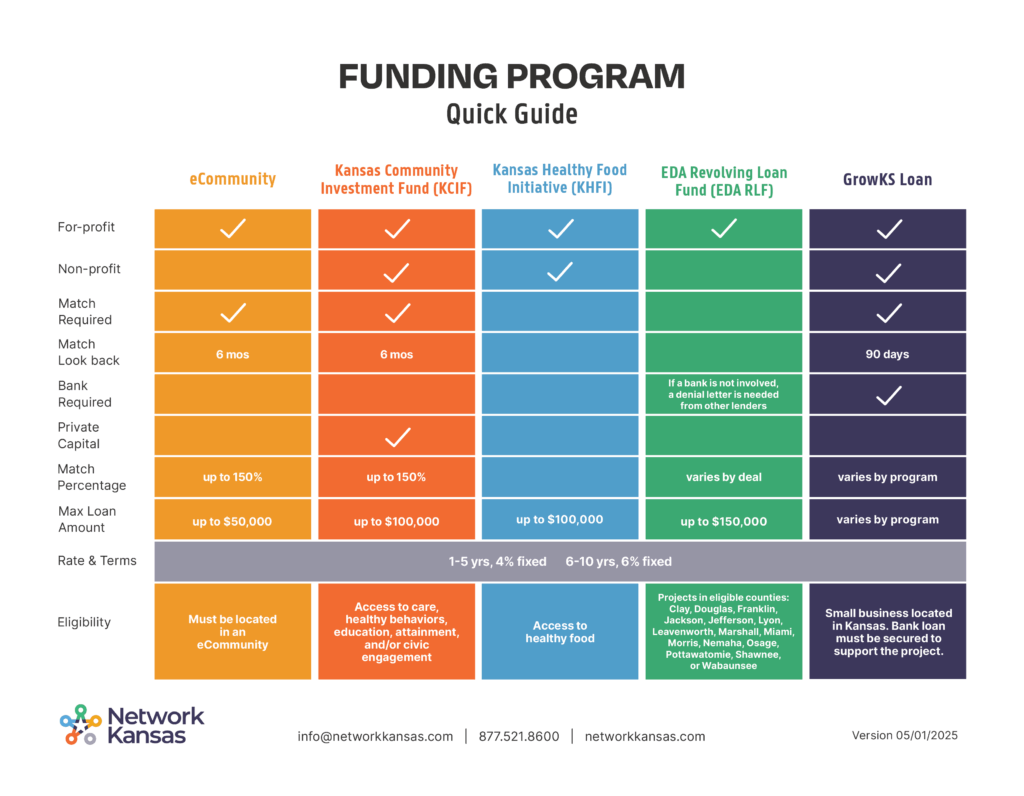

Yes, certain programs require matching funds from private or public sources, depending on the specific loan type. Read our Funding Program Quick Guide for more information.